Farmers have been clear about carbon programs: they want transparency, simplicity, and trust. At Indigo, we agree. And that’s why we are proud to be a founding partner of Ag Carbon Transparent—an industry-led initiative designed to bring clarity,...

Field Notes and Insights

Pending final regulations, upstream CI reduction tactics like RECs and low CI ag feedstocks are likely to be critical for Biofuel plants seeking to lower their CI score and generate more 45Z credits.

As world leaders dive into the AI boom at Davos, resourcing, from energy to water, will be critical.

What ICVCM approval of the soil enrichment protocol means for regenerative agriculture - A big milestone for soil carbon and regenerative farming.

Explore Indigo Agriculture's whitepaper on soil carbon as an affordable, scalable climate solution, and learn how it can help achieve sustainability goals and carbon credits.

Discover the USDA's new climate-smart guidelines for biofuel feedstocks in the 45Z program, promoting sustainable ag and significant CI score improvements.

Discover how regenerative agriculture boosts water conservation. Indigo Ag's programs saved 68B+ gallons of water, supporting ecosystems and communities.

Celebrate World Soil Day by exploring how Indigo Ag helps farmers improve soil health, fight climate change, and conserve resources through innovative practices and technology.

Maximize 45Z tax credits in 2025 by sourcing low-CI feedstocks. Partner with Indigo Ag to create a sustainability program that drives biofuel revenue growth.

Discover how regenerative ag builds soil carbon, enhances farmer resilience, and drives environmental impact with science-backed, large-scale solutions.

Unlock added value per acre with Indigo Ag's enhanced model, approved by Climate Action Reserve. Explore their scientific leadership in driving sustainability.

Finding the right partner to address emissions from land use and agriculture is paramount. Here's a five question checklist to find the right provider

In May 2024, the Biden-Harris administration announced principles for voluntary carbon markets. Understand how Indigo’s carbon credits align.

Indigo Ag’s biological solutions portfolio offers biotrinsic® abiotic products, proven in over 2000+ field trials to support crops in stressful growing conditions, such as drought and heat.

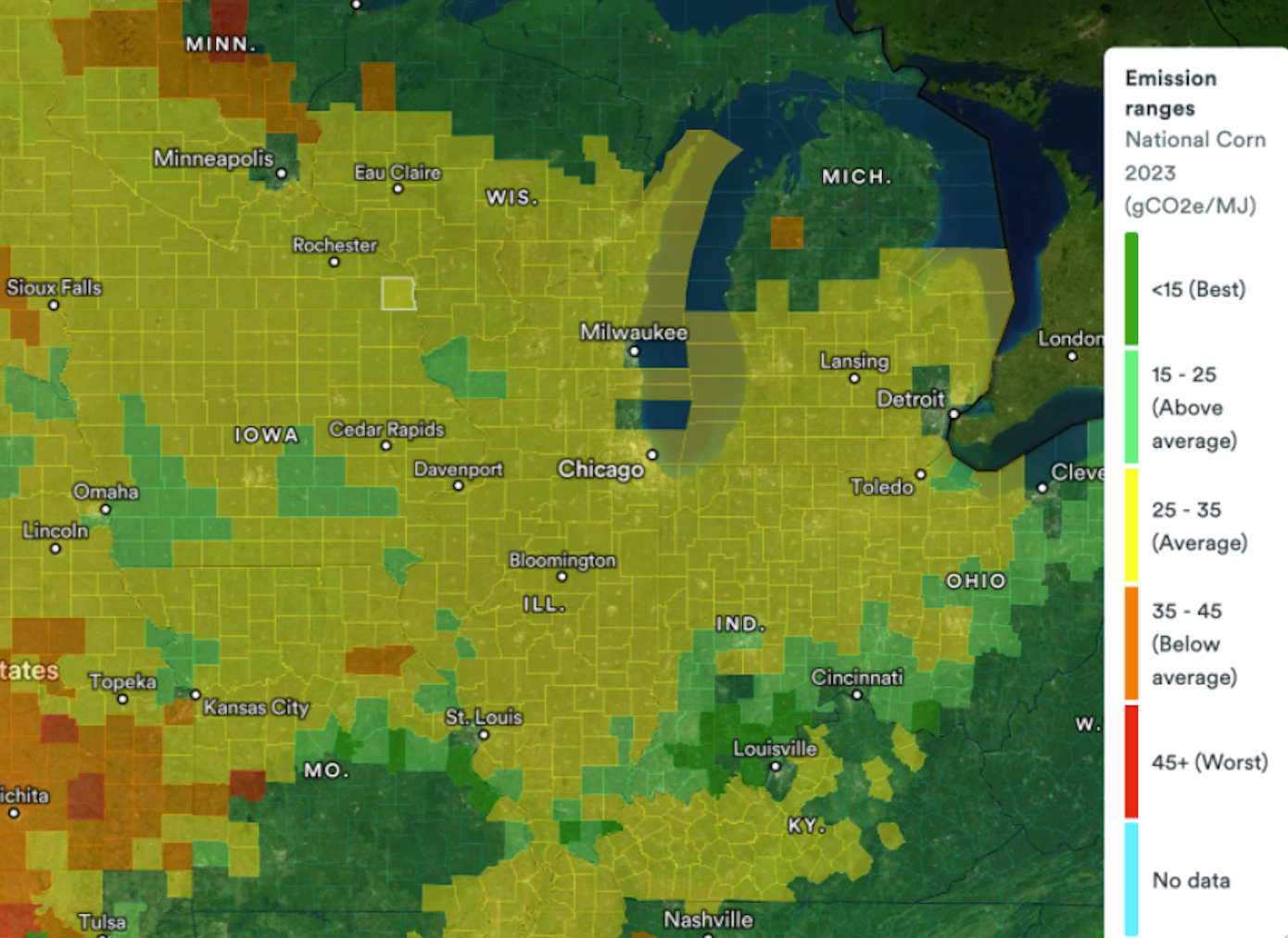

Indigo Ag’s satellite-derived atlas of U.S. agriculture is helping Indigo’s biofuels partners prepare for the launch of upcoming tax credits.

SBTi said it would allow companies to use some environmental attribute certificates, such as carbon credits, for abatement purposes on scope 3 emissions.

Products with lower CI scores may attract premium pricing or preferential market access. Consequently, for grain merchandisers, understanding the CI score of feedstocks, down to the field level, becomes critical in identifying and capitalizing on...

After going from three straight La Nina winters to an El Nino for the 2023-2024 winter, a quick change back to La Nina for summer 2024 is a likelihood, if not a guarantee. So what does this mean for U.S. farmers?

45Z will be the first clean fuels program to include ag-based practices and enable the generation of credits from lower CI ag feedstock in a meaningful way. Participating will require new technologies and ways of working, so consider hiring a...

The biggest fashion brands in the world find themselves at an important but complicated moment in their corporate sustainability journeys—trying to define their SBTi FLAG goals. Here's what you need to know.

-png.png?width=612&height=200&name=Indigo%20Logo%20_%20All%20Countries%20(1)-png.png)